SiC – can it be a Game Changing Technology for Electric Vehicles?

SiC can accelerate the adoption of BEVs

When we build new vehicles that are electric and have smart and connected features, we realise that the significant contribution of automotive electronics to the vehicle performance. We are also aware of the semiconductor chip shortage that has caused great concern to the automotive OEMs. The delay in new product launches or rising frustration of customers due to the longer wait are counter- productive. The traditional semiconductor chip technology has been dominated by Silicon for the last few decades. However, the new breed of vehicles (CASE – connected, autonomous, shared and electric) demand more from the automotive power electronics than what the silicon chips can meet. There is an exponentially rising interest in Silicon Carbide (SiC) that is expected to replace Silicon (Si) in many semiconductors chip application in automotive. The use of Silicone Carbide (SiC) based devices promises a significant reduction in switching losses and permits far higher switching frequencies than what is possible today using pure Silicone (Si) devices.

When we look at what vehicle performance features will encourage users to switch from their ICE vehicles to battery electric vehicles (BEVs), there are at least three themes that emerge strongly

- The BEV users want to get rid of their range anxiety – the automotive OEMs have to provide longer driving range per charge of their EVs

- The BEV users want to charge their EV battery quickly (as they are used to filling their fuel tank very quickly) – the OEMs have to provide fast and safe charging

- The BEV users want their vehicles to operate at high energy efficiency – the OEMs have to minimize the energy losses across the EV sub-systems.

The use of SiC-based chips in EVs promises to increase the efficiency and driving range, while reducing the weight and cost of the entire vehicle [1]. Security of supply is also another factor for the successful adoption of SiC-based chip technology. The world’s first all-SiC powered traction system was installed in the Shinkansen Bullet Trains in Japan as early as 2015.

When there are many EV offerings in the market, the automotive OEMS will look at technology as the basis to create product differentiation. The traction inverter, together with the battery and electric motor, are the three key differentiation elements when comparing technology performance of EVs from different suppliers. Increased inverter efficiency results in lower energy losses on the way from the battery to the motor and enables a longer driving range. The inverter characteristics also have a direct impact on the vehicle performance and user driving experience.

Automotive OEMs, that aim to continuously improve the customer experience of their products, innovate to incorporate a large level of reusability in modular power platform designs and pin to pin compatible solutions and small-scale designs related to Power electronics. The vehicle architecture is seeing a convergence where virtual compute or Zone based computing is going to be used. When installing the power electronics, three factors are decisive: space, weight, and efficiency. Silicon carbide fulfills all the requirements because it has a higher efficiency and can be installed more compactly than conventional semiconductors such as silicon. SiC is a compound semiconductor and is a wide bandgap (WBG) material and its properties are very different from the popular semiconductor material Si. This article aims to introduce SiC-based power electronics and their advantages to the EV product designer.

Why is SiC better Si for power electronics applications in BEVs?

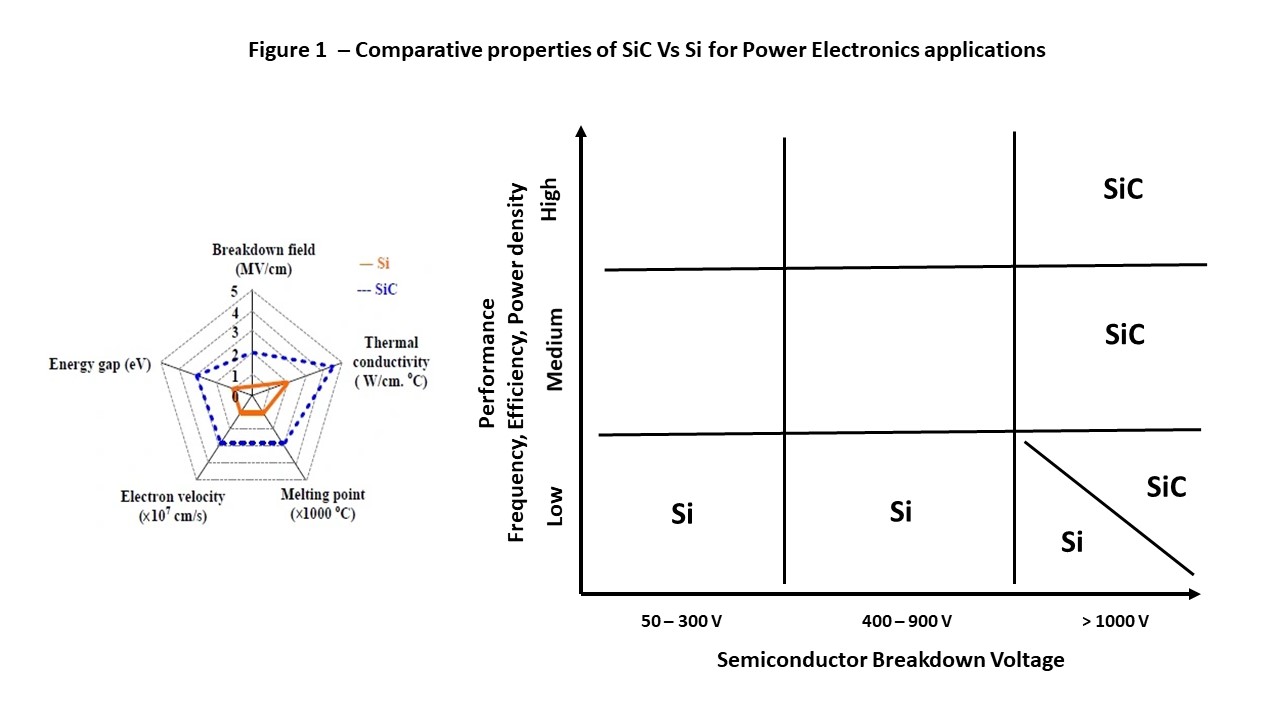

Silicon Carbide (SiC) devices are increasingly used in high-voltage power converters with strict requirements regarding size, weight, and efficiency because they offer many attractive characteristics when compared with commonly used silicon (Si). The on-state resistance and switching losses are considerably lower, and SiC provides about 3× more thermal conductivity than silicon, allowing faster heat dissipation from components. This is important because when Si-based devices become smaller in terms of area, it becomes more difficult to extract the heat generated by electrical conversion processes, and SiC dissipates the heat better. Compared with conventional silicon-based devices, SiC offers essential advantages in automotive applications: increased power density, higher system efficiency, range extension, lower system cost, and long-term reliability. There are many advantages that silicon carbide semiconductor devices offer for automotive application [2]:

Wide bandgap and high-temperature operation: The bandgap of SiC is three times greater than silicon; therefore, SiC devices can operate at higher temperatures. The bandgap energy of 2.3 to 3.3 eV makes SiC devices reliable even at temperatures above 200℃. This is an advantage that makes them suitable for use in automotive and spacecraft sectors. And, SiC devices reduce thermal management costs, as they only require basic cooling.

High-speed operation: SiC devices can operate at higher switching frequencies compared to traditional silicon devices. The high-frequency switching in silicon devices results in switching losses and heat generation problems. The intensity of these problems is less in SiC devices due to the improved electrical and thermal conductivity of the material.

High power efficiency: The power conversion efficiency of SiC power electronics switches is high when compared with silicon-based switches.

Breakdown field strength: The breakdown field strength of SiC is ten times higher than that of silicon. Comparing a silicon MOSFET with an SiC MOSFET, we can see that the latter offers higher withstanding voltages with lower RDS on resistance, thus reducing conduction losses in the device.

Smaller footprint or die size: SiC carbide switches are most often used in systems handling voltages from 600V. For the given breakdown voltage, the die size of SiC devices is smaller than silicon-based devices. SiC devices and their arrangement in higher power circuits is compact and helps with space-saving.

Figure 1 – Comparison of properties of Si and SiC for Power Electronics Applications [7,8]

Figure 1 – Comparison of properties of Si and SiC for Power Electronics Applications [7,8]

Application of SiC in BEVs

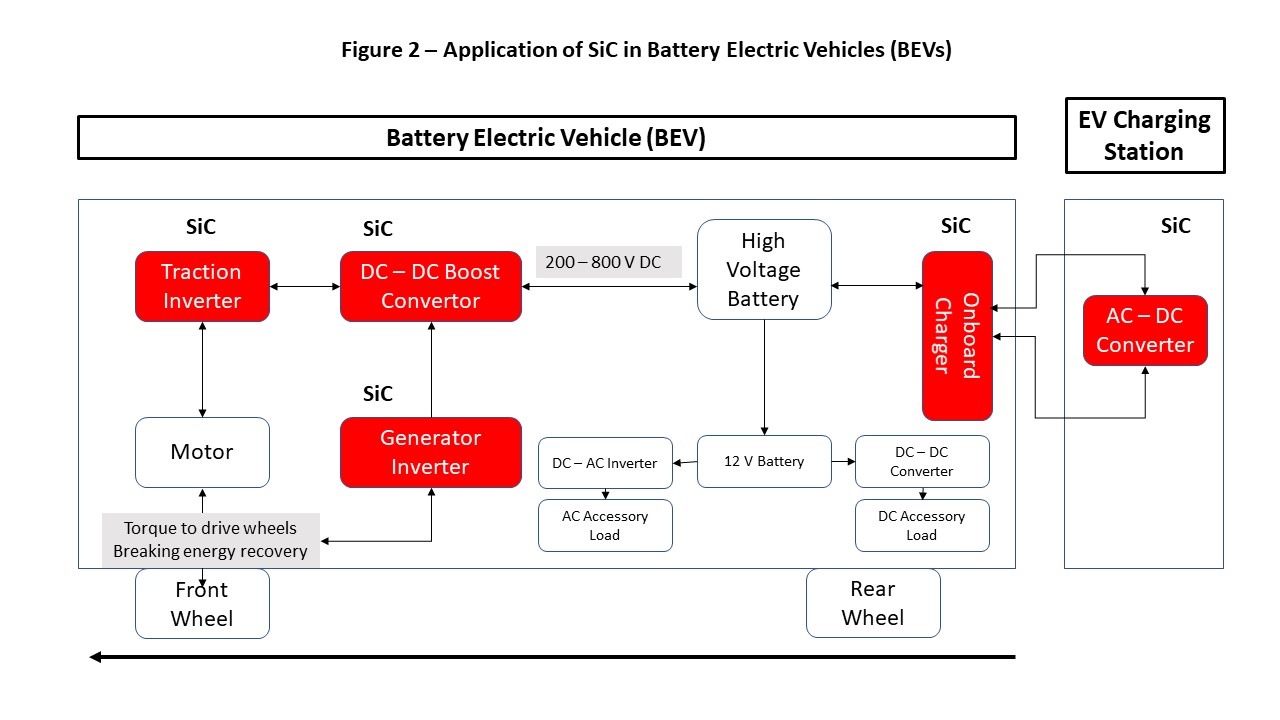

Typical BEV models contain a high-voltage battery varies from 400 to 800 V, along with various electrical systems powering this battery in different ways. These systems include an on-board charger (OBC), a DC/DC converter that serves as a bridge to the 12-V auxiliaries, traction inverters, and the battery management system (BMS) itself. EVs need at least three types of electronic units for energy conversion: DC/DC converter, typically from high voltage to 12 V to power the low-voltage electronics. DC/AC traction inverter to drive the electric motors, typically three-phase, which supply the power to the wheels. AC/DC converters for recharging vehicle batteries both during braking energy recovery and from standard residential or high-power charging stations (for fast charging) [3].

The traction inverter powers the motor and it determines how long vehicles can run until they need to be recharged. In addition, the OBC recharges the battery: The more power we can put into the battery, the faster the charge will be. Most critical of all is the main inverter, which operates at the highest power and facilitates traction. Any efficiency improvements here improve vehicle range without altering the battery capacity. This is driving a rapid transition from silicon IGBTs towards silicon carbide MOSFETs, led by Tesla, which, back in 2017 with the release of the Model 3, introduced the first automotive inverter with custom silicon carbide MOSFETs incorporating copper ribbon-bonding and silver-sintered die-attach pastes, sourced from STMicroelectronics. Today, there is significant growth in the supply chain for silicon carbide MOSFETs with players including ROHM Semiconductor, Cree, Denko, Infineon, Denso, Bosch, Delphi, Vitesco (Continental), Dana and more, expanding production capacity and forming partnerships to keep up with the rapid demand.

The battery is the heart of an EV and must have a very high energy storage density, a self-loss current close to zero, and the ability to charge in minutes instead of hours. BMSs typically include four main circuit groups: OBC, BMS, DC/DC converter, main inverter. The battery charger power blocks consist of an AC/DC front end followed by a DC/DC converter to provide the charge voltage to the battery. The AC/DC section converts the power supply from the mains to a useful DC voltage, avoiding ripple fluctuations. The DC/DC converter provides electrical insulation from the vehicle chassis for safety reasons while providing the necessary DC charging voltage to the vehicle.

By replacing silicon-based designs using IGBTs or MOSFETs in the AC/DC block of the charger with SiC devices, the circuit design is simplified, while power density, and therefore efficiency, are significantly increased, allowing a reduction in the number of parts and size, weight, and cost of the system. The SiC block can also enable the bidirectionality needed to allow the vehicle battery to become part of a smart grid (V2G).

The OBC is the integrated system of the car for charging the high-voltage battery from the AC mains while the vehicle is parked. The trend toward fast charging also affects the power range required by OBC topologies, so the new designs tend to reach 11 kW or even up to 22 kW. This development, combined with the demand for high efficiency and low system cost power density, is a strong incentive for the use of three-phase solutions. Today, there is typically a unidirectional power flow from the mains to the battery, but there is also a two-way use, such as a battery to be charged or battery to the mains. The OBC is also an example of how Si and SiC can coexist in the future.

Thus the benefits arising from SiC-based semiconductor chip electronics are straightforward: lower losses (which means smaller size), higher frequency (smaller passive components), and higher efficiency (simpler and smaller cooling) [3].

Figure 2 – Application of SiC in Battery Electric Vehicles (BEVs)

Figure 2 – Application of SiC in Battery Electric Vehicles (BEVs)

SiC will help EVs meet the future demands

Higher Voltage operation

When BEVs are designed to operate at 400V, silicon is very competitive. By going to higher voltages — 800 to 1,000V, for example — faster charging is enabled with reduced weight and better packaging, thanks to much thinner wires, because higher voltage means fewer current amps at the same power level. 400V battery voltage is prevalent today, but there is a growing need for 800V battery systems. These systems are expected to become the standard as they achieve longer driving range per charge by enabling an increase in density and efficiency without incurring distribution losses or cable-size increase inside the car and on charging stations. SiC’s advantages over silicon technology are even more evident at the 1200V voltage rating required by the 800V bus. SiC can operate at higher switching frequency and potentially at higher temperatures limited by packaging [4].

Compact Electronics

The higher efficiency of SiC translates to more space inside a vehicle. It is very evident in the case of automotive onboard charging. To increase the range, designers increase the battery capacity. This means power levels for onboard charging need to increase, or it would not be possible to fully charge the battery overnight. In future, we may require bi-directional charging, like vehicle-to-grid (V2G). With silicon carbide, not only does efficiency increase, but higher switching frequencies can be realized. This results in smaller passives and reduced cooling effort [4].

5G

Among the most challenging applications for SiC is certainly 5G mobile technology, capable of reaching speeds 20× higher than the previous 4G LTE technology. To operate faster, we need devices that are capable of handling higher power density, have better thermal efficiency, and are optimized for achieving high efficiency. These ambitious performance goals are a perfect match for the strengths offered by SiC devices, such as power MOSFETs and Schottky diodes, capable of operating at voltages of several hundred volts and at temperatures higher than silicon can tolerate [5].

How India is gearing up for the future semiconductor chip technology

The Indian government, it may be recalled, has recently approved a comprehensive program for the development of sustainable semiconductor and display ecosystem in the country at a total cost of Rs 76,000 crore. The Indian government is in active discussion with companies engaged in silicon semiconductor fabs, display fabs, compound semiconductors, silicon photonics, sensors fabs, semiconductor packaging and semiconductor design to set up shop in the country [6].

SiC holds great promise for a number of automotive applications, particularly for BEVs. SiC can extend driving range per charge compared with silicon, reduce the time it takes to charge a battery, and contribute to the overall efficiency equation by providing the same range with lower battery capacity and less weight. SiC-based semiconductor chip technology is of strategic importance to any country aspiring for leadership in electric mobility. Since India does not have much infrastructure for Si-based chip fabrication and is planning to invest and create new infrastructure now, it would be good to leapfrog the technology curve and invest in SiC chip technology (especially for automotive applications). SiC chips, by enhancing the performance of EVs, can accelerate the adoption of sustainable mobility technologies in India.

Author declaration

The views expressed in this article are the author’s personal views.

References

[1] https://www.powerelectronicsnews.com/silicon-carbide-for-the-success-of-electric-vehicles/

[3] https://semiengineering.com/the-silicon-carbide-race-begins/

[4] https://www.i-micronews.com/electric-vehicles-silicon-carbide-sic-era-has-just-begun/

[5] https://www.powerelectronicsnews.com/sic-technology-challenges-and-future-perspectives/

[7] https://www.powerelectronicsnews.com/sic-technology-challenges-and-future-perspectives/

[8] https://www.pntpower.com/question-really-needs-gan-sic-power-devices/

[9] https://www.eetasia.com/the-electric-vehicle-race-to-market/